Welcome to my April 2024 Portfolio Report.

My stock portfolio lost value by -£308.17 (-0.9%) across the month of April 2024. This figure excludes the benefit of any additional deposits made and focuses solely on return achieved on existing capital.

£500.00 additional deposits were pumped into the fund this month, £0.00 worth of stocks were sold, with £713.11 of total capital being invested into additional holdings. £0.00 in additional deposits were made due to income from dividends being transferred into the capital account. The additional deposits and dividend income minus the capital difference invested and account fees has therefore led to an increase in the capital held on deposit which has risen from £356.20 to £116.19

Capital held on deposit now sits at less than 1% of the value of the fund.

The total value of the fund, along with the cash held on deposit sits at £35,364.33

2024 Performance

On 1st January 2024 the account sat at a value of £33,344.41. Since then I’ve pumped in a further £1,300 into the fund. Today’s value of £35,364.33 minus the £1,300 additional deposits, means that I’ve made an investment gain of £719.92 in 2024 which so far represents +2.2% gain in value for the year.

My Thoughts

The dull year continues, without much in the way of movement in either direction at the moment. I feel like we’re in a strange place right now with the markets. Many of the annual reports I’m reading during my analysis are all reporting on 2023’s results.

These are, in the most case, negative in so much that most companies had a tough year and saw reductions in profitability. But the overwhelming consensus across CEO’s and CFO’s and the wider boards are that these companies continue to invest in their future growth. They all expect a economic recovery to come. Most are predicting late 2024, early 2025 before we’ll see much in the way of improved performance across businesses.

This time next year, April 2025, I’ll be up to my neck in 2024 Annual Reports. If what these businesses are saying is correct, 2024 could well, on the most part, be slightly more profitable. So perhaps this is when we might start to see some real movement again? Who knows. I’ve enough self awareness to know that I do not possess the skill or ability to predict the future, unlike many investors who love to speculate what they think ‘might’ happen.

And so I will continue to do my thing. Buying monthly (as and when the funds allow) and buying stocks I consider to either be good value now in the moment, or good value in the future. My buying is probably 80% geared towards the side of seeing value immediately, with 20% going on more speculative plays that I hope will pay off in the future. These tend to be stocks with good growth trajectories which might be somewhat overpriced today, but could end up having been great value in 10 years time when we look back over our shoulders at the price we got them for.

I remain very happy with how things are going. Investors forget sometimes that your results are always going to be somewhat beholden to what is happening with the market as a whole. A friend of mine once ran an Amazon fulfillment business. It didn’t matter how hard he worked and how much effort he put in, sometimes sales were just down because discretionary spending had reduced across the country. He was playing in someone else’s playground. The same sort of thing applies here. The markets are flat. There’s a lot of uncertainty still in where things are headed. So, I don’t expect to be up 30% in such conditions.

Portfolio

| SHARES | STOCK | COST (£) | MARKET (£) | GAIN (£) | GAIN (%) |

|---|---|---|---|---|---|

| 120 | STOCK 1 | 877.62 | 1,388.40 | 510.78 | 58.20 |

| 1152 | STOCK 4 | 7,092.64 | 10,091.52 | 2,998.88 | 42.28 |

| 30 | STOCK 23 | 493.50 | 1,072.80 | 579.30 | 117.38 |

| 51 | STOCK 2 | 1,028.30 | 1,123.53 | 95.23 | 9.26 |

| 1902 | STOCK 25 | 2,584.60 | 2,510.64 | -73.96 | -2.86 |

| 1312 | STOCK 29 | 2,650.31 | 2,282.88 | -367.43 | -13.86 |

| 35 | STOCK 16 | 501.53 | 635.25 | 133.72 | 26.66 |

| 1505 | STOCK 32 | 1,269.04 | 1,459.85 | 190.81 | 15.03 |

| 100 | STOCK 34 | 1,557.70 | 1,531.00 | -26.00 | -1.66 |

| 13 | STOCK 17 | 248.05 | 751.40 | 503.35 | 202.92 |

| 2619 | STOCK 43 | 599.64 | 1,073.79 | 474.15 | 79.07 |

| 392 | STOCK 39 | 1,014.01 | 1,321.04 | 307.03 | 30.28 |

| 109 | STOCK 49 | 409.80 | 293.21 | -116.59 | -28.45 |

| 304 | STOCK 55 | 1,048.02 | 155.04 | -892.98 | -85.20 |

| 154 | STOCK 33 | 3,900.22 | 4,207.28 | 307.06 | 7.87 |

| 50 | STOCK 24 | 800.20 | 595.00 | -205.20 | -25.64 |

| 26 | STOCK 45 | 491.34 | 721.24 | 229.90 | 46.79 |

| 649 | STOCK 56 | 932.12 | 1,103.30 | 171.18 | 18.36 |

| 15 | STOCK 57 | 1,029.91 | 1,350.00 | 320.09 | 31.07 |

| 453 | STOCK 38 | 1,887.08 | 1,580.97 | -306.11 | -16.22 |

| TOTAL | 30,415.63 | 35,248.14 | 4,832.51 | 15.88 | |

| CASH | 116.19 | ||||

| TOTAL PORTFOLIO VALUE | 35,364.33 |

Dividend History

£0.00 was received this month in dividends and re-invested into the fund. I received £0.00 in that same month last year. So it’s about the same.

I have received a total of £231.44 in dividends so far for 2024 which is an average passive income of approximately £58 a month. As with every year, my expectation is for a 2.5% yield from my account each year which amounts to £834 in 2024. We beat that in 2022 and 2023, and this year we will be adding to our positions and hopefully increasing our dividends.

At this point last year we had received a total of £70.68. So we are leaps and bounds ahead already.

I am hoping that this will be the year we finally hit and hopefully surpass that £1,000 dividend milestone. It will be interesting to compare against last year as this year progresses.

- 2023 Dividend Income = £933.11

- 2022 Dividend Income = £836.58

- 2021 Dividend Income = £681.58

- 2020 Dividend Income = £107.75

ALL-TIME DIVIDEND RETURNS

| SHARES | STOCK | COST (£) | YIELD (£) | YIELD (%) |

|---|---|---|---|---|

| 120 | STOCK 1 | 877.62 | 107.45 | 12.24 |

| 1152 | STOCK 4 | 7,092.64 | 402.01 | 5.66 |

| 30 | STOCK 23 | 493.50 | 61.02 | 12.36 |

| 51 | STOCK 2 | 1,028.30 | 19.60 | 1.90 |

| 1902 | STOCK 25 | 2,584.60 | 511.82 | 19.80 |

| 1312 | STOCK 29 | 2,650.31 | 344.06 | 12.98 |

| 35 | STOCK 16 | 501.53 | 7.32 | 1.45 |

| 1505 | STOCK 32 | 1,269.04 | 28.54 | 2.25 |

| 100 | STOCK 34 | 1,557.70 | 388.74 | 24.96 |

| 13 | STOCK 17 | 248.05 | 30.43 | 12.26 |

| 2619 | STOCK 43 | 599.64 | 0.00 | 0.00 |

| 392 | STOCK 39 | 1,014.01 | 40.11 | 3.95 |

| 109 | STOCK 49 | 409.80 | 35.64 | 8.70 |

| 304 | STOCK 55 | 1,048.02 | 191.58 | 18.28 |

| 154 | STOCK 33 | 3,900.22 | 373.31 | 9.57 |

| 50 | STOCK 24 | 800.20 | 41.51 | 5.18 |

| 26 | STOCK 45 | 491.34 | 19.50 | 3.97 |

| 649 | STOCK 56 | 932.12 | 33.43 | 3.58 |

| 15 | STOCK 57 | 1,029.91 | 30.90 | 3.00 |

| 453 | STOCK 38 | 1,887.08 | 0.00 | 0.00 |

| TOTAL | 30,415.63 | 2,666.97 | 8.76 | |

| STOCKS NO LONGER OWNED | 168.06 | |||

| TOTAL DIVIDENDS RECEIVED | 2,835.03 | 9.32 |

Historical Performance Tracker

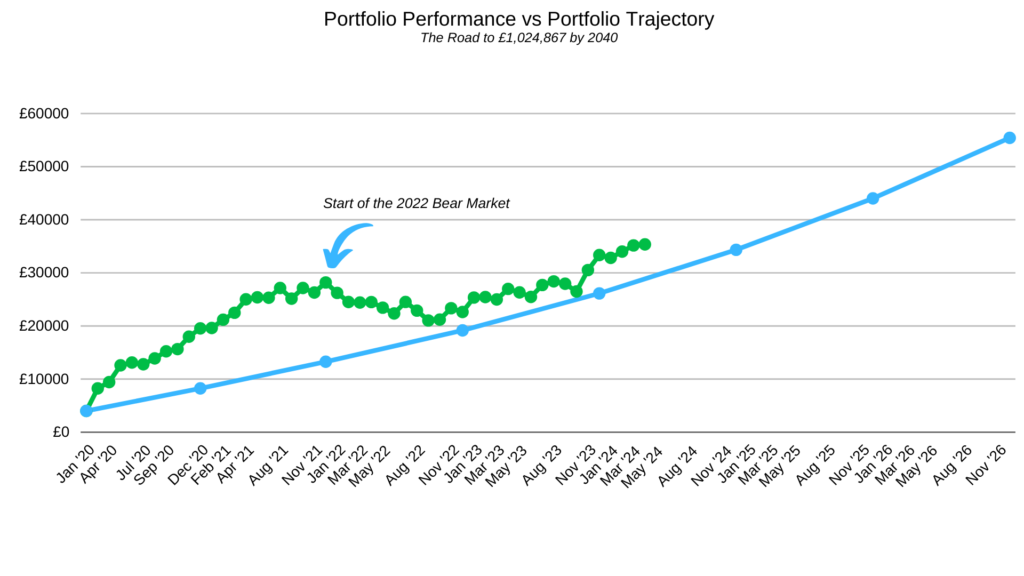

My goal is to reach £1,024,864 in account value within 23 years from the start of this project. I plan to get there by achieving an average annual return of 15% from my stock picks and an additional average 2.5% annual dividend yield which will be re-invested into the fund for compounded growth. This also assumes a £250/month cash input to aid growth.

My financial forecasts suggest that to stay on track and reach my goal I needed to finish 2022 on £19,169. By the end of 2023 I needed to be on £26,132.

The value of my fund sat at £33,344 by the end of 2023. As a result I am ahead of schedule of reaching my target of £1,024,864 by 2042. This is despite the poor market returns of 2020-2023. However, my projections are already based on conversative returns, obtained from historical performance. I am therefore left in no doubt that I will make my target far sooner than planned. Initial projections suggested I would reach my end target aged 61. However, current projections now suggest the milestone will be reached by the age of 59. I hope to get there before I hit 55.

Join Me On My Journey

I hope you continue to join me for this rollercoaster ride across 2024 and our forthcoming years of financial growth. I sincerely hope to one day be able to meet some members in person and bask in each others stories of success. Nothing will please me more than for my hours and hours of analysis to have had significant positive impacts on peoples financial lives and wellbeing. This is an incredible journey, growing a starter portfolio of £4k to £1 million. It will take best part of 20-25 years to achieve.

However, I hope these monthly reports then become a roadmap of sorts that future generations can take. I certainly intend for my children to take on the baton and continue running with it long after I’m gone. For me, this is a the start of the Chillingworth legacy. Whilst I started in my 30’s with less than £10k, my children will start in their 20’s with perhaps £100k each. Their children may start with a million each. Their children could eventually be billionaires. Whilst I won’t be around to witness it, I’d be happy knowing I came into and then left this world having made a positive impact to my family in this way.

The Podcast

If you haven’t yet checked out the Diary of a UK Stock Investor Podcast, you can do so by going to the Podcast page which provides all the links you’ll need to tune in. The Diary of a UK Stock Investor Podcast is a show for everyday retail investors. With a new episode every Thursday, we focus on successful investing in UK stocks discussing education, strategy, mindset, ideas and even stock picks and analysis. The show is curated by Chris Chillingworth, a UK investor for some 9 years whose stock picks have achieved a 15.9% annual average return between Jan 2014 – Jan 2024.