Welcome to my December 2022 Portfolio Report.

My stock portfolio fell in value by £716.70 (+3%) across the month of December 2022. This figure excludes the benefit of any additional deposits made and focuses solely on return achieved on existing capital.

£0.00 additional deposits were pumped into the fund this month, £0.00 worth of stocks were sold, with £0.00 of total capital being invested into additional holdings. £0.00 in additional deposits were made due to income from dividends being transferred into the capital account. The additional deposits and dividend income minus the capital difference invested and account fees has therefore led to a decrease in the capital held on deposit which has fallen from £176.40 to £172.67

Capital held on deposit now sits at 0.75% of the value of the fund.

The total value of the fund, along with the cash held on deposit sits at £22,630.27

2022 Performance

On 1st January 2022 the account sat at a value of £28,192.65. Since then I’ve pumped in a further £2,165 into the fund. Today’s value of £22,630.27 minus the £2,165 additional deposits, means that I’ve made an investment loss of -£7,727.38 so far this year which represents -27.4% loss in value for the year.

My Thoughts

Well, it’s truly been an odd year. On one hand, my portfolio went from being up +31% in returns since 2019, to being down -8% by the end of 2022. On the other hand, i’ve been able to buy £2,165 worth of stock this year at mega reduced rates.

I’d have loved to have bought more but unfortunately my capital was tied up elsewhere and I haven’t been able to be as active as I would have liked.

I have big plans to rectify this in 2023, so I am hoping for a slow recovery so that my window of opportunity does not close too soon. But we’ll see. There are several stocks i’d like to own more of. So trying to put capital to work in 2023 will be a priority. I plan to pump something in first week into January.

No dividends again this December, so I ended the year with £836 incoming from dividends. That’s about a 3% total yield based on my portfolio value of £28,192 which I started the year with. I’m hoping to see my first +£1000 dividend year in 2023 which would be welcomed.

But now it’s a case of sowing the seeds in the winter, as many as I can sow, so that come the harvest I’ll have some wonderful profits. This is the year of getting to work and building a larger portfolio during these depressed prices.

I have no concerns about the value of the portfolio. I’m in this for the long haul. I have another 20 years to go yet before i’ll be looking to sell anything and the world and the markets will be a very different place.

Bear in mind, 20 years ago none of the following existed:-

iPhone, Facebook, Youtube, Instagram, Twitter, TikTok, Android, Bitcoin, Tesla, iPad, Gmail, Netflix, Amazon Prime, Slack, Reddit, Etsy, WhatsApp, Facebook Messenger, Google Maps, Snapchat, LinkedIn, Pinterest, Chrome, Zoom, Skype, Spotify, AirBnB, Uber, Just Eat.

In that time the FTSE 100 has also lost the following companies:-

Boots, BHS, Cable & Wireless, Woolworths, Cadbury Schwepps, Eagle Star Insurance, GA Insurance, Great Universal Stores, House of Fraser, Ladbrokes, Magnet Kitchens, MFI Furniture, Midland Bank, P&O Shipping, Rank Leisure, Sun Alliance & Sun Life Insurance, United Biscuits and more.

Some of these companies were bought out and currently exist under different owners now, others have gone.

My point here being that today’s prices will be a million miles away from where they are today. The world will look very different, and some of the companies we own today will be gone or taken over by others. We’ve already seen AVST and CSP leave the watchlist this year, both the subject of takeovers.

Takeovers aren’t necessarily a bad thing either. It’s simple evolution of business. AVST saw a +18% return in 2022 leading up to their takeover by Norton, USA.

But whilst prices are down in 2022, I suspect we’ll be in a very different place by 2025-26.

But this doesn’t mean we need to be sitting on our hands for the next 3-4 years. On the contrary, it’s time to get to work and get buying what we can before prices recover and begin reaching new highs. Before the price analysis report on the watchlist suddenly begins to lose all it’s green “bargain” stocks and it becomes harder to find cheap opportunities.

I am tremendously excited about the whole journey.

In terms of the year’s performance, to be sitting where I am, despite a -27% hit, I think puts me in great stead. Let’s not forget that this -27% hit has been caused by the wider macro economic conditions we find ourselves in. It has nothing to do with individual performance of the watchlist stocks. The Russian invasion of Ukraine was a completely unforeseen event for most investors that again was no reflection on the companies themselves.

Another year of investing heavily into my portfolio in 2023 and I believe I will be perfectly placed for the market recovery whenever it comes.

Portfolio

| SHARES | STOCK | COST (£) | MARKET (£) | GAIN (£) | GAIN (%) |

|---|---|---|---|---|---|

| 120 | STOCK 1 | 877.62 | 895.20 | 17.58 | 2.00 |

| 683 | STOCK 4 | 3,931.89 | 3,838.46 | -93.43 | -2.37 |

| 30 | STOCK 23 | 493.50 | 832.80 | 339.30 | 68.75 |

| 51 | STOCK 2 | 1,028.30 | 1,006.74 | -21.56 | -2.09 |

| 1902 | STOCK 25 | 2,584.60 | 1,940.04 | -644.56 | -24.93 |

| 991 | STOCK 29 | 2,152.17 | 1,853.17 | -299.00 | -13.89 |

| 35 | STOCK 16 | 501.53 | 560.00 | 58.47 | 11.65 |

| 936 | STOCK 32 | 747.83 | 776.88 | 29.05 | 3.88 |

| 110 | STOCK 34 | 1,557.70 | 1,551.00 | -6.70 | 0.43 |

| 13 | STOCK 17 | 248.05 | 613.60 | 365.55 | 147.37 |

| 2619 | STOCK 43 | 599.64 | 549.99 | -49.65 | -8.27 |

| 138 | STOCK 39 | 249.26 | 343.62 | 94.36 | 37.85 |

| 1855 | STOCK 46 | 2,540.51 | 2,615.55 | 75.04 | 2.95 |

| 109 | STOCK 49 | 409.80 | 545.00 | 135.20 | 33.00 |

| 304 | STOCK 55 | 1,048.02 | 477.28 | -570.74 | -54.45 |

| 219 | STOCK 47 | 1,187.36 | 538.74 | -648.62 | -54.62 |

| 111 | STOCK 33 | 3,068.48 | 2,372.07 | -696.41 | -22.69 |

| 50 | STOCK 24 | 800.20 | 537.50 | -262.70 | -32.83 |

| 26 | STOCK 45 | 491.34 | 609.96 | 118.62 | 24.14 |

| TOTAL | 24,517.80 | 22,457.60 | -2,060.20 | -8.40 | |

| CASH | 172.67 | ||||

| TOTAL PORTFOLIO VALUE | 22,630.27 |

Dividend History

£0.00 was received this month in dividends and re-invested into the fund. We received a total of £836.58 in dividends for 2022 which is an average passive income of approximately £70 a month. I was hoping for a 2.5% yield from my account each year (approx £700 in 2022). This time last year we had received £681 in Dividends.

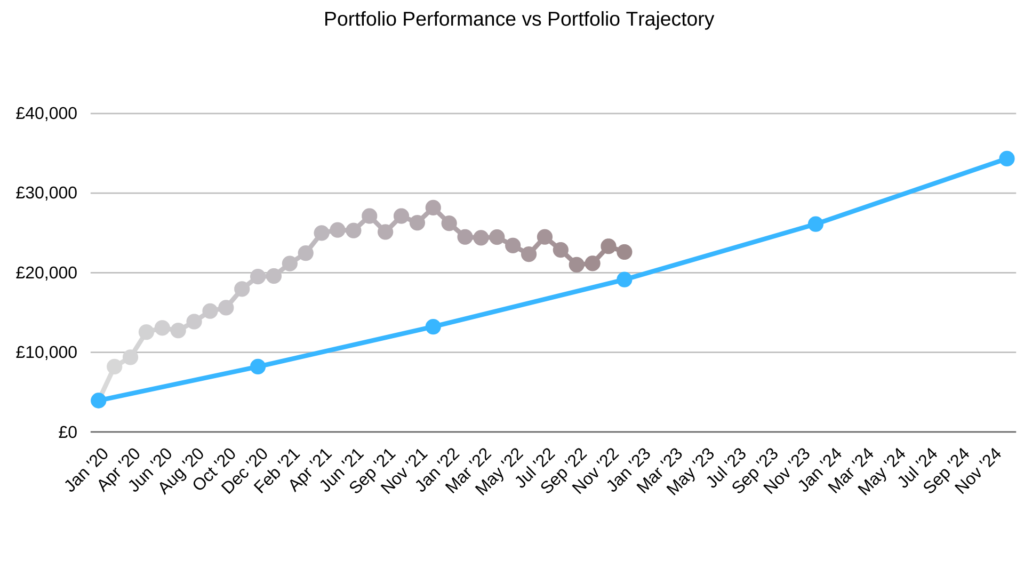

Historical Performance Tracker

My goal is to reach £1,024,864 in account value within 23 years from the start of this project. I plan to get there by achieving an average annual return of 15% from my stock picks and an additional average 2.5% annual dividend yield which will be re-invested into the fund for compounded growth. This also assumes a £250/month cash input to aid growth. This progress is represented as the blue ‘trajectory’ line.

My financial forecasts suggest that to stay on track and reach my goal I must finish 2022 on £19,169.

However, I am approximately 1 year ahead of schedule of reaching my target of £1,024,864 by 2042, which gives me plenty of room should I suffer 1-2 poorer years along the way like we are seeing now in 2022.

These projections are already based on conservative returns, based on historical performance of my handpicked stocks. I am therefore left in no doubt that I will make my target far sooner than planned. Initial projections suggested I would reach my end target aged 61. However, current projections now suggest the milestone will be reached by the age of 59. I hope to get there before I hit 55.

Join Me On My Journey

I hope you continue to join me for this rollercoaster ride across 2022 and our forthcoming years of financial growth. I sincerely hope to one day be able to meet some members in person and bask in each others stories of success. Nothing will please me more than for my hours and hours of analysis to have had significant positive impacts on peoples financial lives and wellbeing.

This is an incredible journey, growing a starter portfolio of £4k to £1 million. It will take best part of 20-25 years to achieve. However, I hope these monthly reports become a roadmap of sorts that future generations can take.

I certainly intend for my children to take on the baton and continue running with it long after i’m gone. For me, this is a the start of the Chillingworth legacy. Whilst I started in my 30’s with less than £10k, my children will start in their 20’s with perhaps £100k each. Their children may start with a million each. Their children could eventually be billionaires. Whilst I won’t be around to witness it, I’d be happy knowing I came into and then left this world having made a positive impact to my family in this way.