Welcome to my January 2023 Portfolio Report.

My stock portfolio rose in value by £2752.21 (+11.4%) across the month of January 2023. This figure excludes the benefit of any additional deposits made and focuses solely on return achieved on existing capital.

£150.00 additional deposits were pumped into the fund this month, £0.00 worth of stocks were sold, with £0.00 of total capital being invested into additional holdings. £10.41 in additional deposits were made due to income from dividends being transferred into the capital account. The additional deposits and dividend income minus the capital difference invested and account fees has therefore led to a decrease in the capital held on deposit which has fallen from £172.67 to £398.74

Capital held on deposit now sits at 1.6% of the value of the fund.

The total value of the fund, along with the cash held on deposit sits at £25,352.48

2023 Performance

On 1st January 2023 the account sat at a value of £22,630.27. Since then I’ve pumped in a further £150 into the fund. Today’s value of £25,352.48 minus the £150 additional deposits, means that I’ve made an investment return of £2,752.21 so far this year which represents +11.4% gain in value for the year.

My Thoughts

The slow recovery I was hoping for to give me time to raise capital to invest before prices accelerated has not played out how I had hoped. Prices have soared quite incredibly in January 2023 despite no real particularly positive news.

Some stocks from the watchlist rose 20% in value in January for instance. To me this feels odd.

The question is, could this be pent up demand? Perhaps we are seeing a return of investors flocking back to the market now because they are seeing a sea of cheap stocks and opportunity and don’t want to miss out.

Or is this something else? A false jump leading to another drop. Look online and it’s not hard to find experts proclaiming more doom and gloom on the horizon. Some even predicting another crash is coming. But unfortunately, those people are always there.

Ultimately, trying to predict what’s coming is a fools game. Even if you get the prediction right, you won’t know until after the event. If you plan for a crash which never comes you shoot yourself in the foot. If you don’t plan for a crash you risk seeing the value of your portfolio fall again.

But personally, I believe the best course of action is to do the same thing I’ve always done. Continue to buy well performing companies at cheap prices relative to their underlying value. If the market crashes again, so be it. Another window to add more

value to my portfolio on the cheap. One needs to always remember (and I am constantly reminding myself of this mantra) that there is no rush to build my wealth. I am buying these stocks with no intention to cash in for 10-20 years. So, whatever happens to the value of my portfolio in 2023 is largely irrelevent. Whether it goes up or down over the next 11 months the only question that’s important is what will the stocks all be worth in 2033-2043?

If the markets crash in 2043 then I might want to delay any cashing in of my portfolio (should I choose to), but if the markets crash in 2023 or 2024, no big deal. I wasn’t planning on selling then anyway.

I know I repeat this almost every month it seems, whether the markets are up or down. But I genuinely believe that this is the core mindset to long term success.

A friend of mine who makes 7 figures a year as a marketing copyrighter once said to me that after years of studying human behaviour the one pattern he’s always seen across his career is that us humans always get in the way of our own success. We always find ways to overthink things and mess it up.

Having spent years working with traders and investors I would say this is spot on analysis. Look at short term traders and their obsession with tinkering with their systems. Or buying a stock and then quickly feeling remorse and selling again. Only to then see the stock do well. Or investors trying to force something to happen and buying terrible penny stocks to try and make a quick profit, only to then lose money instead of make any. The corporate business decisions that create so much fuss and extra work that didn’t need to be changed. The incentive schemes that become so complicated to please all staff that that in the end we find that it’s the simplest of systems that work the best. Even in our everyday relationships we tend to often be our own worst enemy. Overthinking, when really, it all comes down to keeping things simple.

So whilst the threat of seeing our well-earned portfolio values rise in January exists, in the grand scheme of things another crash will mean very little. We just keep it simple. Buying more shares of wonderful business at prices that make sense, and we learn to enjoy the journey and the process, because if you do the little things right, over time the portfolio value will inevitably take care of itself.

Portfolio

| SHARES | STOCK | COST (£) | MARKET (£) | GAIN (£) | GAIN (%) |

|---|---|---|---|---|---|

| 120 | STOCK 1 | 877.62 | 932.40 | 54.78 | 6.24 |

| 683 | STOCK 4 | 3,931.89 | 4,712.70 | 780.81 | 19.85 |

| 30 | STOCK 23 | 493.50 | 819.00 | 325.50 | 65.95 |

| 51 | STOCK 2 | 1,028.30 | 1,095.48 | 67.18 | 6.53 |

| 1902 | STOCK 25 | 2,584.60 | 2,225.34 | -359.26 | -13.90 |

| 991 | STOCK 29 | 2,152.17 | 2,120.74 | -31.43 | -1.46 |

| 35 | STOCK 16 | 501.53 | 640.50 | 138.97 | 27.70 |

| 936 | STOCK 32 | 747.83 | 879.84 | 132.01 | 17.65 |

| 110 | STOCK 34 | 1,557.70 | 1,719.30 | 161.60 | 10.37 |

| 13 | STOCK 17 | 248.05 | 690.82 | 442.77 | 178.50 |

| 2619 | STOCK 43 | 599.64 | 680.94 | 81.30 | 13.55 |

| 138 | STOCK 39 | 249.26 | 362.94 | 113.68 | 45.61 |

| 1855 | STOCK 46 | 2,540.51 | 3,060.75 | 520.24 | 20.48 |

| 109 | STOCK 49 | 409.80 | 374.96 | -34.84 | -8.50 |

| 304 | STOCK 55 | 1,048.02 | 480.32 | -567.70 | -54.16 |

| 219 | STOCK 47 | 1,187.36 | 510.27 | -677.09 | -57.02 |

| 111 | STOCK 33 | 3,068.48 | 2,442.00 | -626.48 | -20.41 |

| 50 | STOCK 24 | 800.20 | 505.00 | -295.20 | -36.89 |

| 26 | STOCK 45 | 491.34 | 700.44 | 209.10 | 42.55 |

| TOTAL | 24,517.80 | 24,953.74 | 435.94 | 1.77 | |

| CASH | 398.74 | ||||

| TOTAL PORTFOLIO VALUE | 25,352.48 |

Dividend History

£10.41 was received this month in dividends and re-invested into the fund. We received a total of £10.41 in dividends for 2023 which is an average passive income of approximately £10 a month. I am hoping for a 2.5% yield from my account each year (approx £625 in 2023). This time last year we had received £13.60 in Dividends.

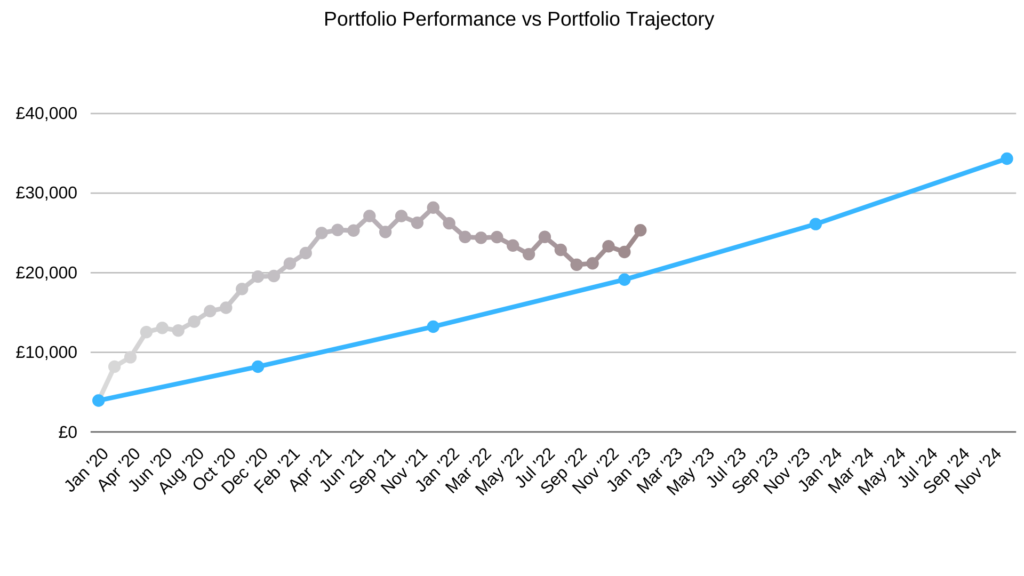

Historical Performance Tracker

My goal is to reach £1,024,864 in account value within 23 years from the start of this project. I plan to get there by achieving an average annual return of 15% from my stock picks and an additional average 2.5% annual dividend yield which will be re-invested into the fund for compounded growth. This also assumes a £250/month cash input to aid growth. This progress is represented as the blue ‘trajectory’ line.

My financial forecasts suggest that to stay on track and reach my goal I had to finish 2022 on £19,169.

However, I am approximately 1 year ahead of schedule of reaching my target of £1,024,864 by 2042, which gives me plenty of room should I suffer 1-2 poorer years along the way like we are seeing now in 2022.

These projections are already based on conservative returns, based on historical performance of my handpicked stocks. I am therefore left in no doubt that I will make my target far sooner than planned. Initial projections suggested I would reach my end target aged 61. However, current projections now suggest the milestone will be reached by the age of 59. I hope to get there before I hit 55.

Join Me On My Journey

I hope you continue to join me for this rollercoaster ride across 2023 and our forthcoming years of financial growth. I sincerely hope to one day be able to meet some members in person and bask in each others stories of success. Nothing will please me more than for my hours and hours of analysis to have had significant positive impacts on peoples financial lives and wellbeing.

This is an incredible journey, growing a starter portfolio of £4k to £1 million. It will take best part of 20-25 years to achieve. However, I hope these monthly reports become a roadmap of sorts that future generations can take.

I certainly intend for my children to take on the baton and continue running with it long after i’m gone. For me, this is a the start of the Chillingworth legacy. Whilst I started in my 30’s with less than £10k, my children will start in their 20’s with perhaps £100k each. Their children may start with a million each. Their children could eventually be billionaires. Whilst I won’t be around to witness it, I’d be happy knowing I came into and then left this world having made a positive impact to my family in this way.

Hi Chris,

Great to read that you have a gain in January. I look forward to discussing with my son, who is a member of your club, how he got on in January. I am on the edge as a silver member. I and my wife live comfortable on pension and savings in an HL ISA portfolio. So I put £5000 into I.G. in 2015 and have fun spread betting my watch list is mainly your picks. In 2022 I lost money like most people. January this year I have made enough profit to cover the previous years loss and a bit more. So thanks to your picks I have moved into the small percentage of those who make a profit spread betting. It will be interesting to see if the year is crash or gain. If gain this year I could move to overall profit on what I started with. Thanks for giving an old man an interest.

Martin E