Welcome to my April 2023 Portfolio Report.

My stock portfolio rose in value by £1742.17 (+7%) across the month of April 2023. This figure excludes the benefit of any additional deposits made and focuses solely on return achieved on existing capital.

£250.00 additional deposits were pumped into the fund this month, £3924.64 worth of stocks were sold, with £3710.70 of total capital being invested into additional holdings. £0.00 in additional deposits were made due to income from dividends being transferred into the capital account. The additional deposits and dividend income minus the capital difference invested and account fees has therefore led to a decrease in the capital held on deposit which has risen from £267.49 to £754.96

Capital held on deposit now sits at 2.7% of the value of the fund.

The total value of the fund, along with the cash held on deposit sits at £26,981.60

2023 Performance

On 1st January 2023 the account sat at a value of £22,630.27. Since then I’ve pumped in a further £900 into the fund. Today’s value of £26,981.60 minus the £900 additional deposits, means that I’ve made an investment return of £3451.33 so far this year which represents +15.25% gain in value for the year.

My Thoughts

The combined 54 stocks of the watchlist rose +3.6% overall in value in April 2023, and my personal portfolio achieved a +7% rise in value. The FTSE 250 rose +2.6%.

This month we received the news that one of my larger holdings Medica Group plc [LSE: MGP] had received a takeover bid from an investment company offering shareholders £2.12 for their shares, and that the bid had been accepted by the board on behalf of the shareholders.

The price of the stock instantly jumped from £1.50 to £2.12 on the market. Instead of waiting for the deal to go through and the stocks to be de-listed, I went ahead and sold my 1855 shares at £2.12 to bank £3924.64 after transaction fees. Realising a profit of £1,384.13 which is a retutn of 54.5% on my investment capital.

As I have stated already in my communication to members via the weekly watchlist report and the notification email I sent out, these deals are likely to happen when we invest in strong growth stocks. They will always attract attention from larger businesses looking to make acquisitions. Typically, whilst these deals will end the growth prematurely for us as investors, they will usually result in profit for us. The costs of buying out existing shareholders will usually need to factor in some kind of a premium in order to get the board and shareholders agreeing it is in their own best interests to sell up. We saw this happen with Avast plc in 2022 when Norton’s takeover lifted the AVST share price from £4.65 to £7.17, and less impressively with CSP which rose from £2.00 to £2.30 on the news of it’s takeover.

Soon after selling up my shares I put the capital back to work and invested in a number of stocks which were priced well at the time. I purchased 398 shares in STOCK 56 at a price which is a great deal to get my first shares in this company. I also purchased shares in STOCK 57 at a price that’s not a million miles away from what I would deem as bargain level, and it was another stock i’d never previously got around to buying. I also purchased 569 shares in STOCK 32 which is a stock which I think is priced criminally low. Bringing my total holding to 1505 shares. Finally, I bought 240 additional shares in STOCK 4 which again I believe is cheap as chips for what you get. It brings my total holding in STOCK 4 to 923 shares.

And so overall I put £3,710.70 back to work and i’ve allowed my cash balance to rise a little before i’ll dive back in again in May and add more to my portfolio.

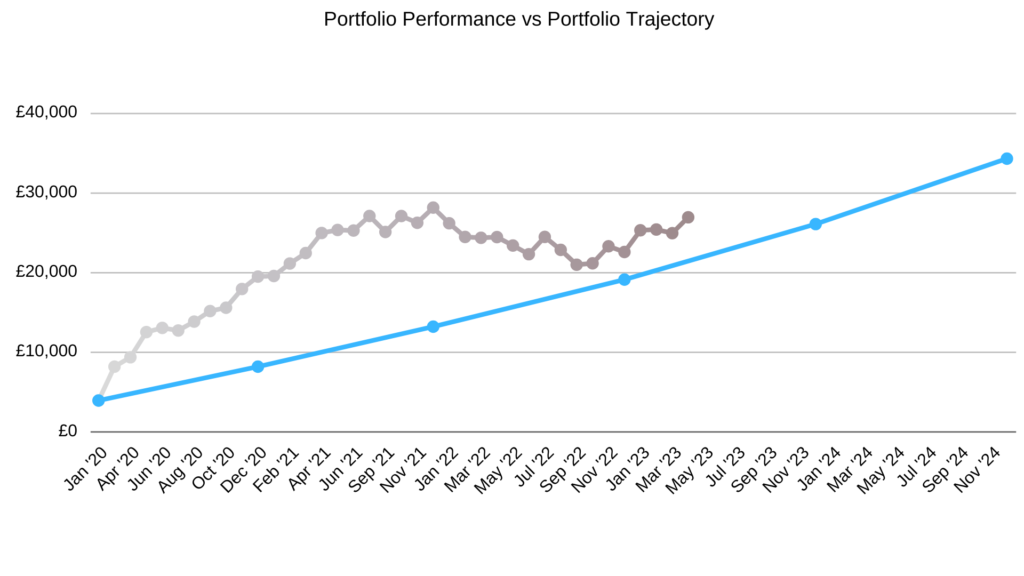

I’m very happy with the progress i’m making. Not necessarily because we’ve seen +15% growth so far in 2023, but because the longer term picture looks solid. There is a chart at the end of this report showing the trajectory of where my portfolio value needs to be at this stage of the journey in order to reach the £1,024,867 target I have set myself. We are above that forecast right now. Bearing in mind the depressed 2022 bear market we’ve experienced which dragged the price of almost all stocks down considerably I feel like we are doing pretty well.

My only regret at this stage is that I haven’t been able to invest more than £900 so far this year.

Chris

Portfolio

| SHARES | STOCK | COST (£) | MARKET (£) | GAIN (£) | GAIN (%) |

|---|---|---|---|---|---|

| 120 | STOCK 1 | 877.62 | 984.00 | 106.38 | 12.12 |

| 923 | STOCK 4 | 5,570.39 | 6,350.24 | 779.85 | 13.99 |

| 30 | STOCK 23 | 493.50 | 811.20 | 317.70 | 64.38 |

| 51 | STOCK 2 | 1,028.30 | 1,179.12 | 150.82 | 14.67 |

| 1902 | STOCK 25 | 2,584.60 | 2,453.58 | -131.02 | -5.07 |

| 991 | STOCK 29 | 2,152.17 | 1,952.27 | -199.90 | -9.29 |

| 35 | STOCK 16 | 501.53 | 614.25 | 112.72 | 22.47 |

| 1505 | STOCK 32 | 1,269.04 | 1,384.60 | 115.56 | 9.11 |

| 110 | STOCK 34 | 1,557.70 | 1,392.60 | -165.10 | -10.60 |

| 13 | STOCK 17 | 248.05 | 608.01 | 359.96 | 145.11 |

| 2619 | STOCK 43 | 599.64 | 654.75 | 55.11 | 9.19 |

| 138 | STOCK 39 | 249.26 | 332.58 | 83.32 | 33.42 |

| 109 | STOCK 49 | 409.80 | 273.59 | -136.21 | -33.24 |

| 304 | STOCK 55 | 1,048.02 | 328.32 | -719.70 | -68.67 |

| 219 | STOCK 47 | 1,187.36 | 608.82 | -578.54 | -48.72 |

| 154 | STOCK 33 | 3,900.22 | 3,569.72 | -330.50 | -8.47 |

| 50 | STOCK 24 | 800.20 | 521.00 | -279.20 | -34.89 |

| 26 | STOCK 45 | 491.34 | 729.04 | 237.70 | 48.37 |

| 398 | STOCK 56 | 521.08 | 489.54 | -31.54 | -6.05 |

| 15 | STOCK 57 | 1,029.91 | 1,012.80 | -17.11 | -1.66 |

| TOTAL | 26,519.73 | 26,250.03 | -269.70 | -1.02 | |

| CASH | 731.57 | ||||

| TOTAL PORTFOLIO VALUE | 26,981.60 |

Dividend History

£0.00 was received this month in dividends and re-invested into the fund.

April is historically a poor month for dividends in my portfolio. We haven’t had an April dividend instalment in April for the last 3 years. However, May has always historically been one of my best dividend payout months of the year, receiving £211 in that month alone last year. So I’m expecting something similar this forthcoming May.

We have received a total of £70.68 in dividends so far for 2023 which is an average passive income of approximately £18 a month. I am hoping for a 2.5% yield from my account each year (approx £625 in 2023). By this time last year we had received £50.29 in Dividends and finished the year on £836.58.

2022 Dividend Income = £836.58

2021 Dividend Income = £681.58

2020 Dividend Income = £107.75

Historical Performance Tracker

My goal is to reach £1,024,864 in account value within 23 years from the start of this project. I plan to get there by achieving an average annual return of 15% from my stock picks and an additional average 2.5% annual dividend yield which will be re-invested into the fund for compounded growth. This also assumes a £250/month cash input to aid growth. This progress is represented as the blue ‘trajectory’ line.

My financial forecasts suggest that to stay on track and reach my goal I had to finish 2022 on £19,169.

However, the value of my fund has already reached nearly £27,000 at this stage. As a result I am approximately 2 years ahead of schedule of reaching my target of £1,024,864 by 2042, which gives me plenty of room should I suffer 1-2 poorer years along the way like we saw in 2022. However, my projections are already based on conservative returns, obtained from historical performance. I am therefore left in no doubt that I will make my target far sooner than planned. Initial projections suggested I would reach my end target aged 61. However, current projections now suggest the milestone will be reached by the age of 59. I hope to get there before I hit 55.

Join Me On My Journey

I hope you will continue to join me for this rollercoaster ride across 2023 and our forthcoming years of financial growth. I sincerely hope to one day be able to meet some members in person and bask in each others stories of success. Nothing will please me more than for my hours and hours of analysis to have had significant positive impacts on peoples financial lives and wellbeing.

This is an incredible journey, growing a starter portfolio of £4k to £1 million. It will take best part of 20-25 years to achieve. However, I hope these monthly reports become a roadmap of sorts that future generations can take.

I certainly intend for my children to take on the baton and continue running with it long after i’m gone. For me, this is a the start of the Chillingworth legacy. Whilst I started in my 30’s with less than £10k, my children will start in their 20’s with perhaps £100k each. Their children may start with a million each. Their children could eventually be billionaires. Whilst I won’t be around to witness it, I’d be happy knowing I came into and then left this world having made a positive impact to my family in this way.