The bargain retailer chain Wilko (formerly Wilkinsons and Wilkinsons Hardware for those old enough to remember) were recently the latest high street retailer to announce their closure as they move into administration.

Reports had surfaced that struggling retailers HMV were close to a rescue deal, but this very quickly fizzled out. Bargain chain retailer B&M who have also been struggling to achieve suitable financial results were also reported to be looking to step in, but again, this seems to have fizzled out again.

Regardless, matters like this intrigue me.

What caused this disaster for the company? When did the warning signs appear? How long have they known this was coming? What was the actual issue? Why were the financial performances so bad?

As a stockmarket analyst, I love delving into the financial numbers. The numbers tell a story. It’s mathematics at the end of the day. The numbers will often show you precisely how, when and why it all went wrong.

And we don’t have to go that deep with Wilko. It’s obvious.

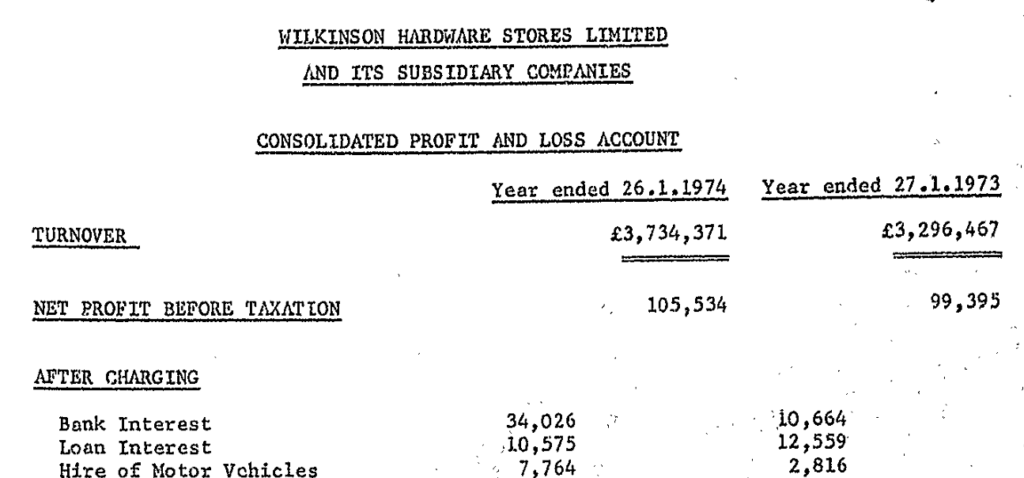

I managed to get my hands on every years worth of financial accounts going all the way back to 1973 when the company had a yearly revenue of £3.3m and recorded a profit of £99,000, a net profit rate of 3%.

Fast-forward some almost 50 years and the company were reporting £1.2 billion in yearly sales in 2021 and a net profit of £4m. A net profit rate of 0.3%.

But I didn’t need to go back 50 odd years to see where things went wrong with Wilko. In fact, I only needed to go back to 2017, some 6 years.

Back then the company were making a net profit of around £3m a year. This was the norm for Wilko. £3m profit was what the owners could expect from the business on a good year. That’s about 0.2% net profit after taxes.

Anyone who knows my work will be aware that we wouldn’t touch any company whose ‘good year’ is a 0.2% return after costs. It leaves the business with no room for growth.

Imagine your own personal finances for a moment. Let’s just imagine for a moment you make £3k a month flat. Achieving a return of 0.2% net profit would mean that after all your costs and expenditures, your bills, your mortgage, your loans, your cost of living, everything. After all of it, you’d be left with £6.

Imagine then, that you need to invest that £6 into trying to grow your income greater than £3k a month. It’s going to be incredibly difficult.

Harder so for Wilko who only had £3m to invest into growing a £1.2bn business.

Yet, this is a typical state of most discount retailers. Living right on the cusp of making a small profit and making a small loss.

The reason I avoid investing in companies like this is because

- They don’t make enough profit to be able to re-invest and grow the business any bigger

- It only takes one big problem to come along and decimate the financials

In Wilko’s case, most reports are suggesting Covid-19 was the problem. And whilst the lockdowns and reduced footfall undoubtedly contributed to the downfall of Wilko, as was the case with Debenhams, Thomas Cook and Mothercare, the problems were there long before. Covid-19 just sped things up.

In 2017, Wilko achieved a £3m net profit, whilst holding £213m in outstanding debts. At the time, the business had a net worth of £104m. That’s the total value of all their assets (tangible and intangible) minus their liabilities. Already, we see a problem. Not only does the level of debt double the actual net worth of the business, but when you’re only making £3m profit a year (on a good year) it means we’re going to have trouble paying down that debt.

Why was debt so high? Because the business wanted to expand, but couldn’t do so self-sufficiently.

Let’s go back to our hypothetical £3k monthly pay slip. The £6 we are left with in our bank account at the end of the month just won’t cut it. We can’t grow on that. So, bad decision making leads you to borrow money instead in the form of a loan. The idea being that you’ll use that loan to grow your income. Only then something happens and you lose a lot of your income. Now you have £-1000 a month left in your bank account after expenses, but you also have this loan to pay back, the vast majority of it needing to be paid back within a couple of years. You’re screwed.

In this hypothetical situation, you’d have struggled to pay off that loan anyway with only £6 left in your account each month. But now you’ve lost your income, at a time when you really needed to raise it, and with the deadline fast approaching, you’re soon going to be telling the bank “i’m sorry, I can’t pay you”.

Well, this is essentially what’s happened at Wilko.

Unfortunately, soon after that, problems emerged.

In 2018, Wilko made a net loss of £-53m. Debts had risen significantly to £267m, whilst net worth sat at £110m. So now we have a business, with debt that amounts to 2.5x the value of the entire business. That means theres no way this debt can be paid off. If the company went into administration, and all their assets were sold to pay off their liabilities, there would still be approximately 157m in liabilities outstanding. Arguably, that might be acceptable business practice providing the company were highly profitable and were growing quickly. But when you are reporting a financial loss of -£53m, pre-covid19, we have a problem.

Of course, then Covid-19 did hit. Yet amazingly, the company reported a profit of £13.9m. One of their best years ever!

So I dug deeper. Only to find that whilst factually true in accounting terms the business did report a £13.9m profit, not all was as it seemed. You see, £37m had come from a ‘one-off’ gain on ‘exchange rate changed on US Dollar currency options’. Not only was it not recurring, but it was nothing to do with the day to day business itself. Therefore simply ‘colouring’ the numbers for that year alone. 2019’s results were not typical of what we would ever expect to see from Wilko again, and so for that reason when running my analysis, I ALWAYS remove one-off non-recurring income or expenditures that are not part of the everyday running of the business. Of course, when removing the £37m one-off income, we see that Wilko technically made a loss of £-23m in 2019. Although only visible by someone who knows what to look for.

By 2020, Wilko was back to making £3.7m in net profits, but now had £276m in debts, and the net worth of the business had fallen to just £99m. So debts are rising, and the net worth of the business is falling.

But it was worse than that. £221m of the £276m was short-term debt. Meaning, debt that typically needs to be repaid within 1 year. Gulp!

This is a prime example of an investors red flag. Run away!!!! You can literally see it coming.

How can a company only making £3m profit a year, even begin to pay down a debt that high in such a short time frame.

Anyone looking at the financials knew this business was in trouble in 2017. By 2019, they must have been certain that the business would fail. They can’t have expected anymore than the typical £3m profit a year they’d been seeing in the past. So how they ever thought they would be able to pay down that debt level is beyond me.

In 2022, disaster inevitably struck. With the cost of living expenses hitting the UK public, coupled with the rise in energy prices, and now with £276m of debt needing to be repaid, £221m of which was now due, the company, with a net worth of £99m, couldn’t pay it’s debts.

Even in administration, with their assets sold, their lenders will not get the vast majority of their money back and Wilko will cease to exist.

Companies like HMV and B&M simply aren’t in a position to ‘rescue’ anyone, certainly not the likes of Wilko and their £276m worth of liability owed.

And so, once again, another retailer fails, not just due to Covid-19 (although it would have proved to be the nudge off the edge that sealed their fate), but because of poor decision making in my opinion. Poor financial planning. Borrowing far too much capital relative to the size of the business.

I only invest in businesses that are self-sufficient. High consistent profits between 10-20%, that are doing the right things with that leftover capital. Growing their business within their own means, at the right rate and speed, without the need to borrow capital. This is why my handpicked stocks have achieved an average 16.9% annual average return since 2014.