Welcome to my December 2023 Portfolio Report.

My stock portfolio gained value by £2,569.46 (+8.4%) across the month of December 2023. This figure excludes the benefit of any additional deposits made and focuses solely on return achieved on existing capital.

£250.00 additional deposits were pumped into the fund this month, £0.00 worth of stocks were sold, with £0.00 of total capital being invested into additional holdings. £11.54 in additional deposits were made due to income from dividends being transferred into the capital account. The additional deposits and dividend income minus the capital difference invested and account fees has therefore led to an increase in the capital held on deposit which has risen from £682.38 to £941.52

Capital held on deposit now sits at 2.8% of the value of the fund.

The total value of the fund, along with the cash held on deposit sits at £33,344.41

2023 Performance

On 1st January 2023 the account sat at a value of £22,630.27. Since then I’ve pumped in a further £3,215 into the fund. Today’s value of £33,344.41 minus the £3,215 additional deposits, means that I’ve made an investment return of £7,499.14 this year which represents +33.1% gain in value for the year.

My Thoughts

I’ve had to check and re-check these numbers, but yes, they are correct. Somehow, I managed to achieve a 33% return this year.

How? Well, it was entirely down to the unique makeup of my portfolio. You see, whilst the wider FTSE 250 achieved a 2.9% return for 2023, and my selection of handpicked stocks from my analysis achieved a far better 9.7% return for the year, I do not own an equal holding in all 52 handpicked stocks. In fact, I only own 20 of the 52, and certainly not in equal measure.

My top 3 holdings all achieved over +10% returns each for the month, and my 4th largest position rose by far more. It was these big moves (as well as others) that catapulted my returns in November and December. In fact, the vast majority of my holdings all rose in December.

As always, i’m both joyous of the growth, whilst also mindful that my favourite stocks are now more expensive now than they were at the start of 2023. But wow, what a wonderful example of the benefit and value added of analysing and picking your own stocks. When the top 100 stocks in the UK collectively rose 2.4% and the Top 250 rose 2.9% I think I can safely say that my 33% return is evidence that not only picking my own stocks adds tremendous value, but knowing the price at which to buy them is key.

I would be first to admit that my results would not be anywhere near as bountiful if I had spent the year overpaying for stocks.

The combination of knowing exactly which stocks to buy and when to buy them has absolutely led to me being able to increase my portfolio value by a third. In a year where I should have had no expectations of doing so. A year where most investors should be happy with any profit at all. 2023 truly has been a very important year, adding to the previous others, for showing the value of the work I am doing. And for that reason I am definitely feeling a sense of achievement.

Portfolio

| SHARES | STOCK | COST (£) | MARKET (£) | GAIN (£) | GAIN (%) |

|---|---|---|---|---|---|

| 120 | STOCK 1 | 877.62 | 1,407.60 | 529.98 | 60.39 |

| 1152 | STOCK 4 | 7,092.64 | 9,377.28 | 2,284.64 | 32.21 |

| 30 | STOCK 23 | 493.50 | 1,074.60 | 581.10 | 117.75 |

| 51 | STOCK 2 | 1,028.30 | 1,164.84 | 136.54 | 13.28 |

| 1902 | STOCK 25 | 2,584.60 | 2,795.94 | 211.34 | 8.17 |

| 1312 | STOCK 29 | 2,650.31 | 2,322.24 | -328.07 | -12.38 |

| 35 | STOCK 16 | 501.53 | 626.50 | 124.97 | 24.92 |

| 1505 | STOCK 32 | 1,269.04 | 1,489.95 | 220.91 | 17.41 |

| 110 | STOCK 34 | 1,557.70 | 1,691.80 | 134.10 | 8.61 |

| 13 | STOCK 17 | 248.05 | 710.06 | 462.01 | 186.26 |

| 2619 | STOCK 43 | 599.64 | 969.03 | 369.39 | 61.60 |

| 138 | STOCK 39 | 249.26 | 422.28 | 173.02 | 69.41 |

| 109 | STOCK 49 | 409.80 | 281.22 | -128.58 | -31.38 |

| 304 | STOCK 55 | 1,048.02 | 273.60 | -774.42 | -73.89 |

| 154 | STOCK 33 | 3,900.22 | 4,133.36 | 233.14 | 5.98 |

| 50 | STOCK 24 | 800.20 | 425.00 | -375.20 | -46.89 |

| 26 | STOCK 45 | 491.34 | 676.52 | 185.18 | 37.69 |

| 398 | STOCK 56 | 521.08 | 668.64 | 147.56 | 28.32 |

| 15 | STOCK 57 | 1,029.91 | 1,217.70 | 187.79 | 18.23 |

| 147 | STOCK 38 | 762.59 | 674.73 | -87.86 | -11.52 |

| TOTAL | 28,115.35 | 32,402.89 | 4,287.54 | 15.24 | |

| CASH | 941.52 | ||||

| TOTAL PORTFOLIO VALUE | 33,344.41 |

Dividend History

£11.54 was received this month in dividends and re-invested into the fund.

I have received a total of £933.11 in dividends so far for 2023 which is an average passive income of approximately £78 a month.

At the start of the year I explained I was hoping for a 2.5% yield from my account each year which would have amounted to £625 in 2023. So I have therefore already achieved this target which is very pleasing. By this time last year I had received £836.58 in dividends. So we’re ahead of last years year to date total.

I will have to wait another year to reach that £1000/yr dividend milestone. The lack of special dividends being paid in 2023, in addition to no longer receiving Medica Group plc’s dividends after being sold due to the takeover, means we didn’t reach that nice wholesome £1000 milestone. It was still somewhat leaps and bounds above the anticipated £625, and an improvement on 2022’s total of £836, however, so I certainly won’t be complaining.

2022 Dividend Income = £836.58

2021 Dividend Income = £681.58

2020 Dividend Income = £107.75

Historical Performance Tracker

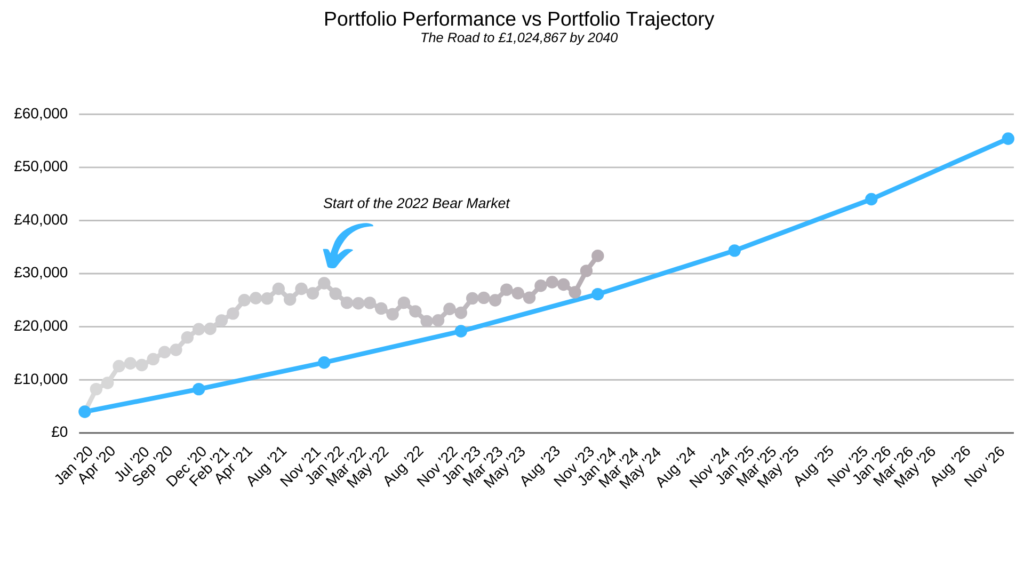

My goal is to reach £1,024,864 in account value within 23 years from the start of this project. I plan to get there by achieving an average annual return of 15% from my stock picks and an additional average 2.5% annual dividend yield which will be re-invested into the fund for compounded growth. This also assumes a £250/month cash input to aid growth.

My financial forecasts suggest that to stay on track and reach my goal I needed to finish 2022 on £19,169. By the end of 2023 I needed to be on £26,132.

The value of my fund sits at £33,344 by the end of 2023. As a result I am ahead of schedule of reaching my target of £1,024,864 by 2042. This is despite the poor market returns of 2020-2023. However, my projections are already based on conversative returns, obtained from historical performance. I am therefore left in no doubt that I will make my target far sooner than planned. Initial projections suggested I would reach my end target aged 61. However, current projections now suggest the milestone will be reached by the age of 59. I hope to get there before I hit 55.

Join Me On My Journey

I hope you continue to join me for this rollercoaster ride across 2023 and our forthcoming years of financial growth. I sincerely hope to one day be able to meet some members in person and bask in each others stories of success. Nothing will please me more than for my hours and hours of analysis to have had significant positive impacts on peoples financial lives and wellbeing. This is an incredible journey, growing a starter portfolio of £4k to £1 million. It will take best part of 20-25 years to achieve.

However, I hope these monthly reports then become a roadmap of sorts that future generations can take. I certainly intend for my children to take on the baton and continue running with it long after I’m gone. For me, this is a the start of the Chillingworth legacy. Whilst I started in my 30’s with less than £10k, my children will start in their 20’s with perhaps £100k each. Their children may start with a million each. Their children could eventually be billionaires. Whilst I won’t be around to witness it, I’d be happy knowing I came into and then left this world having made a positive impact to my family in this way.

The Podcast

If you haven’t yet checked out the Diary of a UK Stock Investor Podcast, you can do so by going to the Podcast page which provides all the links you’ll need to tune in. The Diary of a UK Stock Investor Podcast is a show for everyday retail investors. With a new episode every Thursday, we focus on successful investing in UK stocks discussing education, strategy, mindset, ideas and even stock picks and analysis. The show is curated by Chris Chillingworth, a UK investor for some 9 years whose stock picks have achieved a 15.9% annual average return between Jan 2014 – Jan 2024.